A Personal Note from Nomzamo:

Today is February 10th. Valentine’s Day is just around the corner, and everyone’s talking about love and romance.

But here’s my truth: February 14th has always been MY day first.

It’s my birthday.

I don’t know the full story of Valentine and honestly, I don’t need to. I know MY story. I know the day God gave me breath and purpose. And I celebrate that—unapologetically.

Perhaps it’s a little selfish, but I love my life. I bless God for the day I was born. I celebrate the woman I’m becoming. I honor the journey He’s walked me through.

And yes, I also honor my husband for the love he’s given me—the partnership, the support, the way he sees me and celebrates me. That matters too.

But this day? It starts with celebrating the gift of my own life.

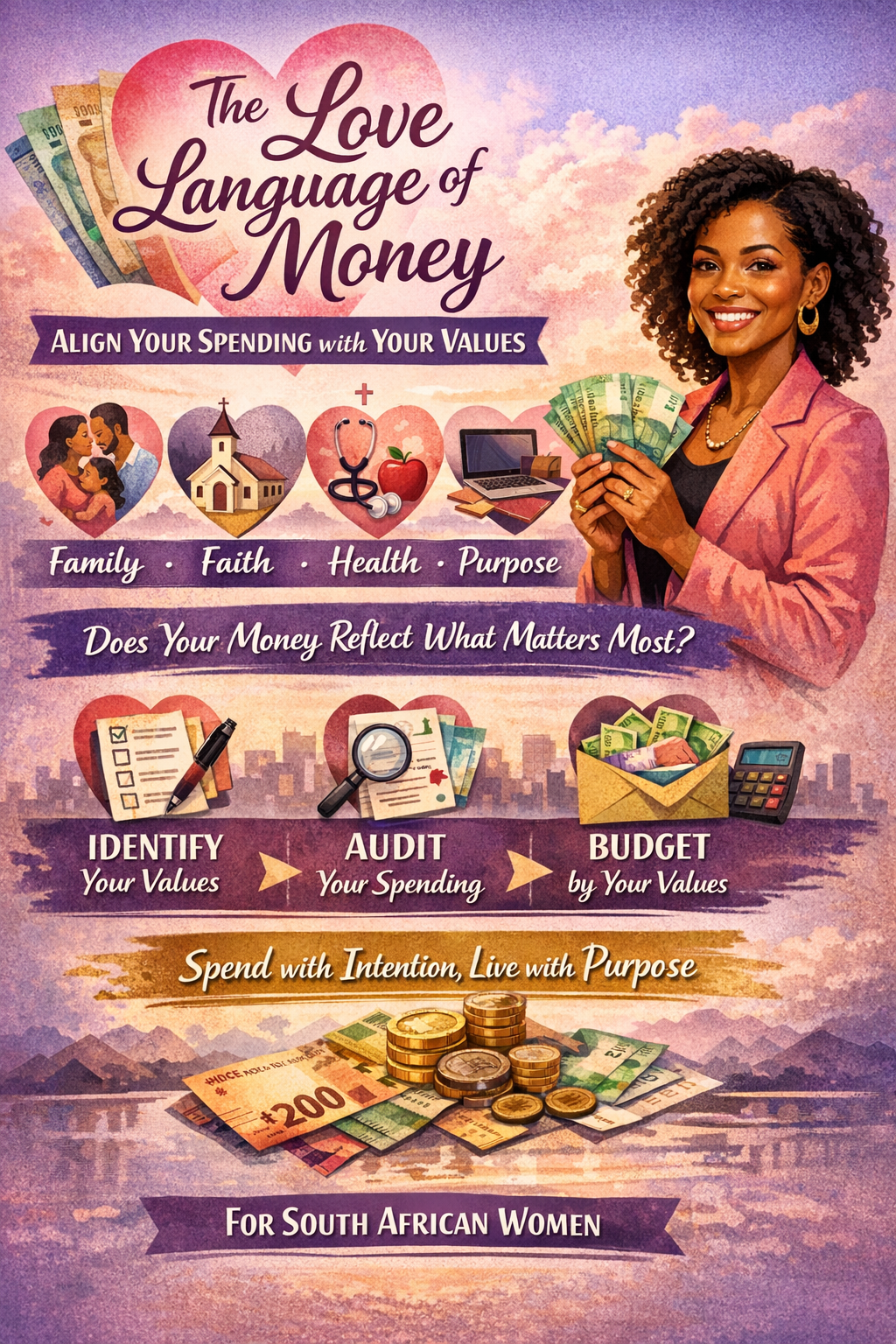

So when we talk about the “love language of money” today, we’re starting here: loving yourself enough to align your money with what truly matters to you.

Not what matters to society. Not what looks good on Instagram. Not what your family expects.

What matters to YOU.

Because when your spending reflects your values, you’re speaking love to yourself, your family, your future, and your purpose.

Let’s make your money speak your love language.

Money Speaks Your Love Language

Here’s something I’ve learned: Money is more than rands and cents. It’s a reflection of your priorities, your commitments, and yes—your love language.

Just as words of affirmation or acts of service communicate love in relationships, the way you spend your money communicates what you truly value in your financial life.

The question is: Does your money reflect what you say you love?

Every Purchase is a Statement of Value

When you spend R500 on groceries to cook a family meal, you’re saying “nourishing my family matters.”

When you invest R1,000 in a course that grows your business, you’re saying “my growth and purpose matter.”

When you tithe R2,000, you’re saying “my faith and obedience to God matter.”

When you spend R3,000 on things you can’t even remember buying? You’re saying… well, you’re not saying much of anything intentional.

Your spending patterns reveal your priorities more clearly than your words ever could.

And here’s where it gets uncomfortable: Sometimes there’s a disconnect between what we SAY we value and where our money actually goes.

We say family is everything, but we’re too exhausted from overwork to invest time or money in family experiences.

We say health is important, but our bank statements show more takeaway orders than fresh groceries.

We say we’re building a business, but we’re spending more on looking like an entrepreneur than on actual revenue-generating activities.

Misalignment between values and spending creates stress, guilt, and that nagging feeling that something’s off.

But alignment? Alignment creates peace.

Why Values-Based Budgeting Matters

Let me show you the difference between traditional budgeting and values-based budgeting:

Traditional Budgeting vs. Values-Based Budgeting

| Traditional Budgeting | Values-Based Budgeting |

|---|---|

| Focuses on numbers and categories | Focuses on meaning and purpose |

| Cuts costs to “save money” | Aligns spending with what matters |

| Feels restrictive (“I can’t have this”) | Feels empowering (“I choose this”) |

| Short-term fixes | Long-term fulfillment |

| Guilt when you “break” the budget | Peace when spending serves your values |

Traditional budgeting says: “You can only spend R1,000 on entertainment this month.”

Values-based budgeting says: “I value quality time with my family, so I’m allocating R1,000 to activities that create memories together.”

Same money. Completely different energy.

The Benefits of Values-Based Budgeting:

1. Clarity You know exactly where your money goes and why.

2. Confidence You spend without guilt because every purchase serves a purpose.

3. Connection Your finances reflect love for your family, faith, health, and purpose.

4. Control You’re making intentional choices, not reacting to impulses or pressure.

5. Contentment When your money aligns with your values, you stop comparing yourself to others because you’re running your own race.

This isn’t about perfection. It’s about intention.

Practical Steps to Align Money with Values

Okay, enough theory. Let’s get practical.

Step 1: Identify Your Core Values

Write down your top 3-5 values. Not what SHOULD matter. What actually matters to YOU.

Examples:

- Family security

- Faith and giving

- Health and wellness

- Education and growth

- Purpose-driven living

- Financial freedom

- Community and relationships

- Creativity and self-expression

My Top 5:

- Faith

- Family

- Health

- Business/Purpose

- Community

Now write yours:

Step 2: Audit Your Spending (The Uncomfortable Truth)

Pull up your bank statements from the last 3 months. Yes, all of them.

Go through every transaction and ask yourself:

Does this expense reflect my stated values? Is this purchase helping me live the life I want? If I saw this on someone else’s statement, what would I think their priorities are?

Create categories:

- Housing (rent/bond, utilities)

- Food (groceries, eating out)

- Transportation

- Family (activities, kids, household)

- Faith (tithing, giving)

- Health (medical aid, gym, wellness)

- Personal development (courses, books, coaching)

- Business (tools, marketing, growth)

- Entertainment

- Debt payments

- Savings

- Miscellaneous (the stuff you can’t categorize)

Add up how much went to each category.

Now compare your spending categories to your stated values.

Does the money match the mouth?

If you said “family” is your #1 value but you spent R200 on family and R2,000 on random shopping, there’s a gap.

No judgment. Just awareness.

Step 3: Create Your Values-Based Budget

Now let’s build a budget that reflects what actually matters to you.

Allocate percentages of your income to each value.

Example (based on R20,000 monthly income):

Faith/Giving: 10% = R2,000

- Tithing to church

- Charitable giving

- Supporting community needs

Family: 40% = R8,000

- Groceries and household needs

- School fees or educational support

- Family activities and experiences

- Extended family support (“Black tax”)

Health: 15% = R3,000

- Medical aid

- Gym/fitness

- Healthy food choices

- Therapy or wellness

Purpose/Business Growth: 20% = R4,000

- Business tools and systems

- Courses or coaching

- Marketing

- Savings for business investment

Fun/Personal: 15% = R3,000

- Personal care (hair, nails, skincare)

- Hobbies

- Entertainment

- Social activities

TOTAL: R20,000

Notice: Every rand has a purpose tied to a value. Nothing is “miscellaneous spending.”

Customize this to YOUR values and YOUR income.

Step 4: Set Boundaries

Now that you know your values and your budget, set clear boundaries:

Say NO to:

- Expenses that don’t align with your top 3 values

- Impulse purchases that serve no purpose

- Social pressure spending (“Everyone’s doing it”)

- Guilt-based spending (“I should buy this”)

Say YES to:

- Purchases that serve your stated values

- Investments in your growth and purpose

- Quality over quantity

- Experiences over things (when that aligns with your values)

This doesn’t mean you never have fun or never splurge. It means every choice is intentional.

Step 5: Review Monthly

Values evolve. Seasons change. Your budget should reflect that.

At the end of each month, review:

- Did my spending align with my values this month?

- Where did I overspend? Why?

- Where did I underspend? Why?

- Do my values need adjusting for this season?

- What’s one thing I’ll do differently next month?

This isn’t about judgment. It’s about iteration and growth.

Making It Real: South African Context

Let’s talk about what values-based budgeting looks like in our specific South African context.

Value: Family

South African Reality:

- School fees (January is brutal)

- Groceries for extended family

- “Black tax” obligations

- Water shedding solutions (water storage tanks, JoJo tanks, bottled water)

- Infrastructure failures (roads collapsing from poor drainage, endless water shutdowns)

- Funeral cover and unexpected family expenses

Values-Aligned Spending:

- Prioritize school fees first

- Set boundaries on extended family support (decide what you CAN give, not what’s demanded)

- Budget for water security solutions (tanks, storage containers) so family life isn’t disrupted by endless shutdowns

- Create a family emergency fund for unexpected needs and infrastructure failures

Value: Faith

South African Reality:

- Tithing and church offerings

- Supporting community initiatives

- Helping neighbors and friends in need

- Ubuntu-based giving (communal support)

Values-Aligned Spending:

- Set up automatic tithing so it’s non-negotiable

- Budget for spontaneous generosity

- Give cheerfully, not out of guilt or pressure

- Remember: You can’t pour from an empty cup

Value: Health

South African Reality:

- Medical aid is expensive but essential

- Gym memberships often go unused

- Fresh, healthy food costs more than processed

- Mental health support (therapy) is often not covered

Values-Aligned Spending:

- Prioritize medical aid—don’t skip this

- If gym is unused, cancel and use free alternatives (YouTube workouts, outdoor running)

- Budget for fresh produce even if it costs more (health is wealth)

- Allocate funds for therapy or wellness if needed

Value: Purpose/Business Growth

South African Reality:

- Side hustles are essential for many

- Water shedding affects daily business operations (can’t run certain businesses without water)

- Data costs are high

- Business registration and compliance costs

- Infrastructure failures impact client service delivery

Values-Aligned Spending:

- Invest in tools that actually generate revenue (not just look professional)

- Budget for water storage and backup solutions if your business requires water

- Invest in reliable data solutions

- Choose one learning investment per quarter, not every course you see

- Track ROI—is this expense growing the business or just making you feel busy?

- Plan for infrastructure disruptions in your service delivery

Common Challenges and Solutions

Challenge 1: Rising Costs and Infrastructure Collapse

South African Reality: Our cost of living is rising faster than most salaries. Everything costs more—fuel, food, and now we’re dealing with water shedding. It’s not load shedding anymore; it’s water being shut down for endless periods. Roads are collapsing from poor drainage when the rains come. Municipalities give excuse after excuse about “fixing pipes” while families go days without running water.

Solution:

- Prioritize essentials that align with your top 2 values

- Budget for water storage solutions (JoJo tanks aren’t cheap, but neither is buying bottled water constantly)

- Cut non-value expenses ruthlessly (subscriptions you don’t use, convenience spending)

- Find creative alternatives (cook at home instead of takeaway, carpool, shop specials)

- Build infrastructure resilience into your budget (this is the new reality)

- Accept that you may need to earn more (side hustle aligned with your purpose value)

Challenge 2: Peer Pressure and Social Comparison

South African Reality: Social media makes it look like everyone’s thriving. Weddings, lobola, keeping up appearances—the pressure is real.

Solution:

- Stay grounded in YOUR values, not society’s expectations

- Unfollow accounts that make you feel inadequate

- Remember: People post highlights, not bank statements

- Choose authenticity over image

Challenge 3: Debt

South African Reality: Many of us are carrying debt while trying to support family, build businesses, and survive inflation.

Solution:

- Align repayment strategy with your values

- Debt payoff frees resources for family and purpose (keep the WHY clear)

- Use Snowball or Avalanche method (we covered this in the debt blog)

- Don’t take on new debt while paying off old debt

Challenge 4: Extended Family Expectations (“Black Tax”)

South African Reality: Cultural obligations to support extended family can conflict with your own financial goals.

Solution:

- Set clear boundaries on what you can afford

- Communicate openly: “I can contribute R___ this month”

- Don’t go into debt to meet others’ expectations

- Teach family members to fish (help them build skills/income) rather than just giving fish

Practical Tools for Values-Based Budgeting

Tool 1: The Envelope System

Withdraw cash for each value category and put in labeled envelopes.

Example:

- Envelope 1: Family (R2,000)

- Envelope 2: Health (R1,000)

- Envelope 3: Fun (R500)

When the cash is gone, you’re done spending in that category for the month.

Why it works: Cash is tangible. Card spending is abstract and easier to overspend.

Tool 2: Digital Budgeting Apps

Recommended for South Africans:

- Vault22 (free, connects to SA banks)

- YNAB (You Need A Budget) – more advanced

- Simple spreadsheet (Google Sheets or Excel)

Set up categories that match your values, not generic budget categories.

Tool 3: Vision Board

Create a visual representation of your values.

Example:

- Family: Photo of your loved ones

- Faith: Scripture about stewardship

- Health: Image representing your wellness goals

- Purpose: Vision for your business

Place it where you see it daily. Link every spending decision to the vision.

Tool 4: Accountability Partner

Share your values and budget with one trusted person who will:

- Check in monthly

- Celebrate your wins

- Lovingly call you out when you drift

- Remind you of your WHY when temptation strikes

Real-Life Examples: Values-Based Budgeting in Action

Thandi’s Story: Education Value

Before:

- Spent R3,000/month on entertainment and eating out

- Struggled to save for daughter’s university fees

- Felt guilty and stressed about the future

After Values Alignment:

- Identified education as top value

- Redirected R2,500 from entertainment to education savings

- Still budgeted R500 for fun (not deprivation)

- Result: Saved R30,000 in one year toward university, felt peace instead of guilt

Nomsa’s Story: Health Value

Before:

- Spent R2,000/month on luxury shopping

- Skipped medical aid to “save money”

- Ignored health issues until they became emergencies

After Values Alignment:

- Prioritized health as core value

- Cut luxury shopping to R500

- Invested R1,500 in medical aid

- Result: Caught health issue early, avoided R15,000 emergency cost, felt secure

Zanele’s Story: Faith and Family Balance

Before:

- Gave sporadically to church

- Felt guilty about not giving more

- Also felt guilty spending on family needs

After Values Alignment:

- Set automatic 10% tithe (faith value)

- Budgeted 40% for family needs (family value)

- Stopped guilt spending on both

- Result: Peace in giving, peace in providing, no more guilt

The Pattern: When spending aligns with values, guilt decreases and peace increases—even when income doesn’t change.

The Long-Term Impact of Values-Based Budgeting

When you commit to aligning your money with your values, here’s what shifts over time:

1. Financial Freedom

Not because you have more money, but because the money you have is working for what matters.

Less stress. More joy. Intentional choices instead of reactive spending.

2. Generational Wealth

You’re not just managing money—you’re teaching your children values through money.

They see that spending serves purpose. They learn delayed gratification. They understand stewardship.

This is legacy.

3. Purposeful Living

Every rand spent reflects love and meaning.

Your budget becomes a love letter to yourself, your family, and your future.

Your bank statement tells a story of intention, not confusion.

4. Spiritual Alignment

When your money aligns with your values (especially faith), you experience spiritual peace.

You’re stewarding what God gave you with wisdom. You’re trusting Him as provider while taking wise action.

“For where your treasure is, there your heart will be also.” — Matthew 6:21

Your money reveals your treasure. But you get to choose your treasure.

Your 30-Day Values Alignment Challenge

Ready to make your money speak your love language? Here’s your action plan:

Week 1: Clarity

☐ Write down my top 5 values ☐ Pull 3 months of bank statements ☐ Categorize all spending ☐ Compare spending to stated values ☐ Identify biggest gap (no shame, just truth)

Week 2: Design

☐ Assign percentages to each value ☐ Create values-based budget for next month ☐ Set spending boundaries (what I’ll say no to) ☐ Choose one tool (envelope system, app, or spreadsheet) ☐ Share with accountability partner

Week 3: Implement

☐ Start using my values-based budget ☐ Track daily: Does this purchase serve my values? ☐ Pause before every purchase: “Which value does this serve?” ☐ Redirect one expense from non-value to value category ☐ Celebrate one intentional choice

Week 4: Review & Adjust

☐ Monthly review: Did spending match values? ☐ Where did I align? (Celebrate!) ☐ Where did I drift? (Learn, no shame) ☐ What needs adjusting for next month? ☐ Commit to one improvement

Let Your Money Speak Love

As I celebrate my birthday this week—MY day, before Valentine’s, before anyone else—I’m reflecting on what it means to love myself well.

Loving myself means aligning my money with what I say matters.

It means honoring my faith, investing in my family, prioritizing my health, pursuing my purpose, and building community.

It means every rand I spend is a vote for the life I want to live.

This Valentine’s season, let your money reflect your heart.

Aligning spending with values isn’t restrictive—it’s liberating.

When your budget mirrors your deepest priorities, every rand becomes a love letter to yourself, your family, your faith, and your future.

So here’s my birthday wish for you: Make your money speak your love language.

Not society’s language. Not comparison’s language. Not guilt’s language.

Your language. Your values. Your purpose.

Because you, sister, are worth that intention.

“She is clothed with strength and dignity; she can laugh at the days to come.” — Proverbs 31:25

Ready to create a values-based budget that actually works? I offer discovery sessions where we identify your values, audit your spending, and build a personalized budget aligned with what matters most. Book here. Or Join Financial Femme for a free 15-minute Financial Health Check. Exclusive to 5-Day Email Course subscribers.

Need budgeting tools? Download the free Vision to Action Workbook here which includes templates for values clarification and budget planning.

Blessings, Love & Intentionality,

Nomzamo Khosa

Elevate Finance Partners

P.S. Happy Birthday to me! 🎉 And to you—make THIS the season your money finally matches what your heart values. What’s the first value you’re aligning your spending with? Share below. 💜

Leave a Reply